American expats have been caught in the IRS crack down on unreported foreign income and bank accounts. Several high profile non expat cases have resulted in jail time for taxpayers failing to report large amounts of income on their tax returns. However, many expats have found that IRS treatment has been fairly forgiving. This is because many American expat tax returns should include either or both of two benefits that may reduce the expat's tax to zero: the foreign earned income exclusion and the foreign tax credit.

When you have inventory you are on modified cash basis and that is the preferred 2290 tax form method for sole proprietorships and the one I have found works best with artists.

The Child Care Credit Form 2290 online allows parents and guardians of qualifying children and disabled adults to claim the costs of child and dependent care on their tax return. It is a non-refundable credit that does not automatically qualify you for a tax refund. However, if you have costs to claim it is a good idea to do so in order to lower your taxable income and pay less tax.

He played college football on scholarship for four years and competed in three drug-free bodybuilding contests. Currently he competes in the Police E-file 2290 Olympics, which consist of swimming, a 5K run, a 100m sprint, throwing a shot put, the rope climb, and the bench press. Personally he is training for an adventure race, which consists of mountain biking, canoeing, and a run.

I would like to go into the differences between a C corporation and an S corporation. C is the corporations we are most familiar with - corporate monsters like Microsoft, IBM, Disney, Sears, etc. These get IRS heavy vehicle tax at a corporate rate, which is currently 15% up to $50,000 in profit, and goes up from there. An S Corporation (S stands for Small) has to have less than 100 stockholders (among other requirements) but does NOT get taxed at the corporate level. Let me repeat that - no tax is paid on the corporation itself. Instead, the income gets reported on each shareholder's tax return, and is paid at their personal rate. This is usually the better deal for small companies, as personal returns are not taxed at all for the first $7000 in income.

You can request either type of transcript by mail or by phone. The phone number is 1-800-829-1040. If you wish to request a transcript by mail you'll need the IRS address that pertains to your specific area. If you need a photocopy of a previously processed tax return request Form 4506 which is a Request for Copy of Tax Form.

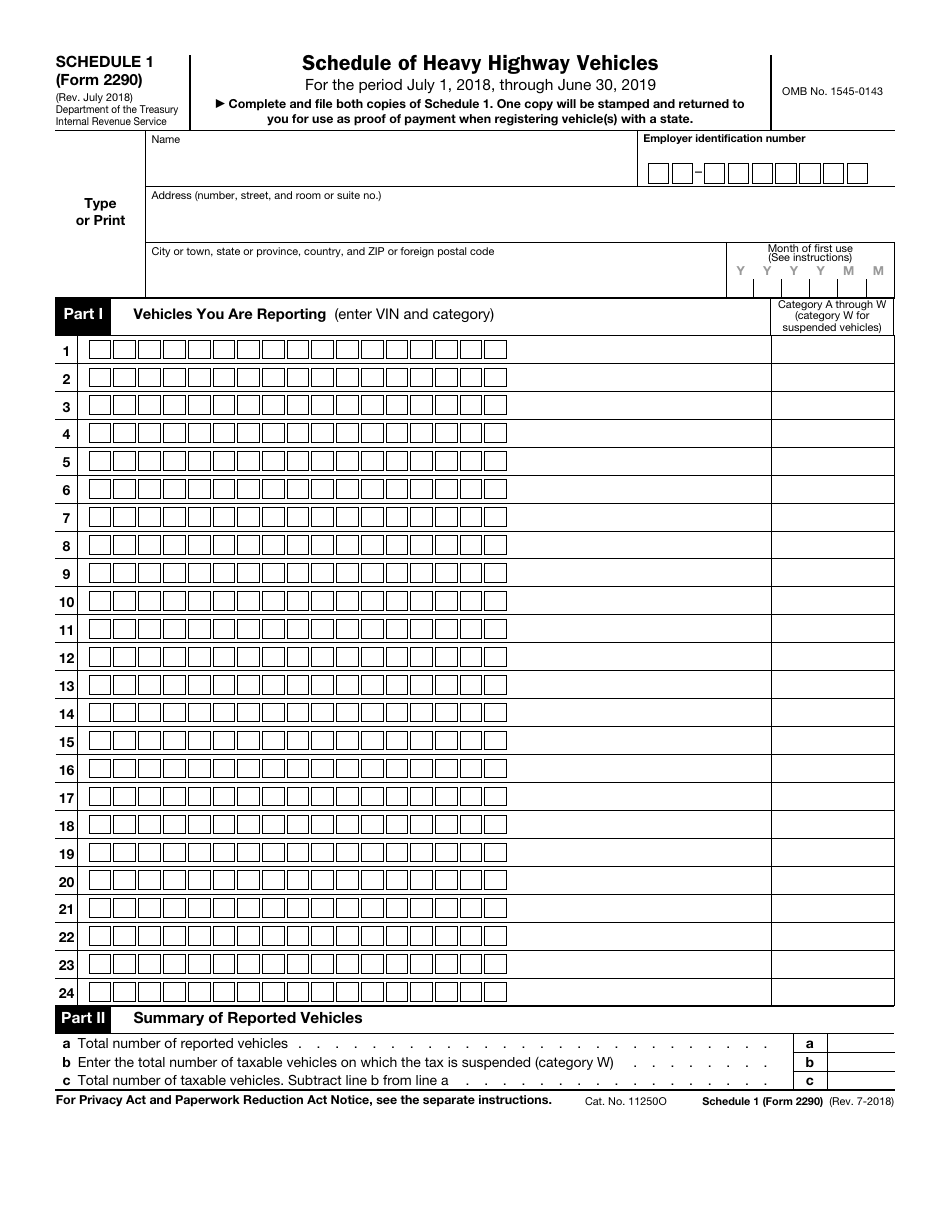

If you want to hire a company to help you with Heavy Highway Vehicle Use Tax but you still have reservations, consult a financial expert. This individual can give you a clearer picture on how a firm can help solve your dilemma.